How to Know Which Turbo Tax to Use

I need to know if I filed my taxes with turbo tax. Will I still be able to use the state turboTax I p.

Turbotax Review 2022 The Easiest Tax Software To Use

See How Easy It Really Is Today.

. Turbo Tax does have its own free service but its only available to certain people filing simple tax returns ABC-affiliate News 10 in Albany New York reported. You can also confirm if your tax return was received by the CRA in your CRA My Account but it can take up to 48 hours after you file for your My Account to reflect that your return was received. People love to say did it myself and dont need no expensive accountant Right.

Turbo Tax will no longer participate in the IRS Free File Program starting Jan. A surge in suspicious tax filings this year has highlighted how difficult it is. Tax Filing Is Fast And Simple With TurboTax.

By the way they do nothing to aler. Even though TurboTax could tell we were eligible to file for free the company never told us about the truly free version. I need to know if i filed my federal taxes with turbo tax on.

We highly recommend using it because its the fastest way to get your refund and filing with paper forms will result in a delay in processing. Access to a TurboTax product specialist is included with TurboTax Deluxe Premier Self-Employed TurboTax Live and TurboTax Live Full Service. What are some TurboTax alternatives.

What you need to know if youre planning to use TurboTax. Ideal for 1099-NEC incomes this TurboTax version helps you complete all relevant self-employment tax forms and will also let you know if a Schedule SE or Self-Employment Tax is required by the. Access to a TurboTax product specialist is included with TurboTax Deluxe Premier Self-Employed TurboTax Live and TurboTax Live Full Service.

At TurboTax we make it easy to get your taxes done rightTurboTax H. TurboTax Premier costs 69 to file your federal taxes and an. I bought turbo tax CD for windows at Best Buy.

Turbo tax is fools gold. TurboTax Help and Support. See the heading in the left column titled Commonly Filed Tax Forms and Schedules.

Not sure about the separate vs. Once your return loads in the top left corner next to the TurboTax Logo you will see the name of the current version you are using. Did you know that if you rented your home out for 14 or fewer days you can exclude that rental income from your tax return because of the Augusta Rule.

TurboTax Premier or Self Employed will support Schedule D transactions. Filing your taxes online couldnt be easier. We use TaxCut instead of TurboTax.

Say Thanks by clicking the thumb icon in a post. This is way more advanced than what they offered even just a few years ago and I was excited that there was a button for every scenario I encountered over the year between my. I need to reinstall Turbo tax.

Step 1 Tell TurboTax about your tax situation. The most popular way to file Federal and State taxes free is the TurboTax Free EditionIn fact TurboTax claims that an average of over 10 million taxpayers students low income seniors etc use the Free Edition every year However we must emphasize that the Free Edition is for simple tax returns only. Not included with Free Edition but is available as an upgrade.

Ad With 100 Accurate Calculations TurboTax Helps You Get Your Max Refund Guaranteed. Turbo Tax is no longer allowing users to use the IRS free filing program. Continue your return by click Taxes Tax Timeline Take me to my return.

And TaxCut is a piece of cake. Sure so why is it that the IRS admits that taxpayers overpay their taxes by billions of dollars. You can take the following steps to see what TurboTax Online version you are using.

When youve successfully transmitted your tax return to the CRA through NETFILE youll receive a NETFILE confirmation numberLearn how to find your NETFILE confirmation number. We have a house deductions stocks etc. You can create an account with TurboTax and begin filing your tax return.

Not sure why because we used to use TurboTax but DH switched and said he likes TaxCut much better. TurboTax specialists are available to provide general customer help and support using the TurboTax product. First TurboTax will ask you some basic questions.

It turns out that if. Please see the comparison of tax products at this page. TurboTax specialists are available to provide general customer help and support using the TurboTax product.

Mark the post that answers your question by clicking on Mark as Best Answer. Joint return question but I know it is very flexible. Customers who have itemized deductions unemployment income reported on a 1099-G business of 1099-NEC income stock sales income from rental properties charitable donations education donations.

Not included with Free Edition but is available as an upgrade. Installed and used for tax r. So if you would otherwise have a very simple tax situation except for rental income of 14 or fewer days you could still use the free editions.

Answer 1 of 6. You can click on My Account Tools My Fees. Sign into TurboTax Online.

Know that if you have self-employed income sell investments or if you own rental real estate youll have to use one of the next two versions we talk about here. TurboTax Help and Support. As you can see TurboTax is stepping up its game quite a bit and you can now select a variety of options based on your tax situation.

Taxact Vs Turbotax 2022 Nerdwallet

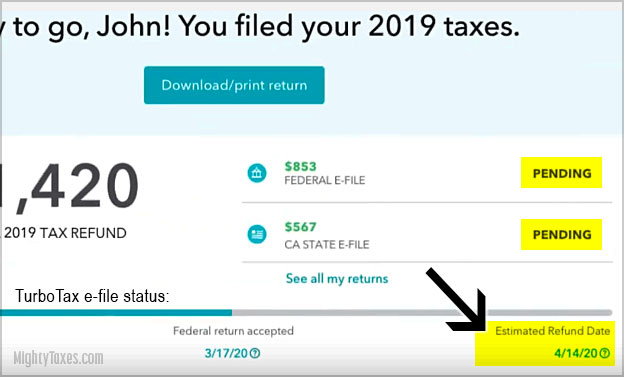

Turbotax How To Check Your E File Status

How Do I File My Taxes Using Turbotax Online Turbotax Support Video Youtube

Comments

Post a Comment